The module market is going through turmoil, and prices are changing daily. There is a huge gap in demand and supply, resulting in a crisis like situation. There have been multiple factors affecting this market over the months, which can be summarised as below:

COVID-19:

The COVID-19 pandemic has now spread its black shadow worldwide, influencing almost every market sector, including the solar module industry, one of the fastest-growing sectors. Manufacturing and logistics which have slowed the module industry’s growth, are undeniably the primary industries withering due to coronavirus (COVID-19). According to industry analysts, one out of every five top manufacturing solar module firms relies on the Chinese market to supply products and materials. However, all manufacturing sectors are in a state like that of the 2008 crisis, with China factories still closed and travel facilities banned worldwide. Chinese vendors who have also dominated the market for modules since 2018, the leading five suppliers accounted for 60% of global cellular module shipments and revenue captured is 71% of the market. Their failure to export modules to different parts of the world has exacerbated the situation.

And since this pandemic has hit almost all countries, finding alternative routes has also become nearly impossible. It is Something that is highlighting that the coronavirus effect on the module industry is dreadful.

Shortage of PV module Raw material:

In July 2020, reports emerged of a series of flash explosions at a GCL-Poly Energy owned plant in north-western region Xinjiang experiencing an output disruption taking down more than 10% of the global supply of the solar power raw material out of production (Source: www.pv-magazine.com )

Polysilicon prices have increased more than 60% afterwards. This caused a huge disruption in the module market. Solar module prices remained unstable due to the interplay of several factors exacerbated by these explosions in China’s leading polysilicon manufacturing units.

The solar industry had an unusual year in 2020. Module prices started increasing in mid-2020 because of a supply disruption caused by floods in China’s southeast province. Tongwei Group, a Chinese feedstock and solar raw material supplier, was forced to shut down a quarter of its polycrystalline silicon capacity due to this unusually severe flood. This has altogether hit supplies across the globe. Even after some time, prices stabilized after a while, but they started increasing again in the last quarter of 2020. This is because of the bottleneck in adequate glass-processing capacity caused due to several unexpected turmoils in manufacturing, logistics, and the supply chain of solar module, hampering supply and drove up prices in a short period. Furthermore, there are shortages of glass, EVA, and other products, resulting in a price increase. It has been anticipated a lack of solar modules and materials supplies throughout the world.

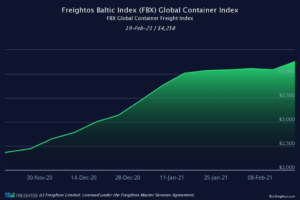

Freight rates hike:

Besides raw materials, freight rates have shot up 5-8 times due to a shortage of shipping containers. Rising consumer demand and constrained supply of containers is disrupting the seas. Moreover, several importers postponed their plans due to the pandemic, resulting in a drop in orders from Chinese suppliers during the summer. As a result, the second and third quarters of 2020 also resulted in a 5-15 per cent drop in transhipments in European ports. In response, the shipping cost is increasing rapidly, mainly exporting from China. For example, some of the latest reports showed spot freight rate from Asia to northern Europe increased by 3% over the previous week, 145% over the beginning of this year.

Solar Modules and Indian market:

India’s solar manufacturing lags the major global players, notwithstanding being one of the largest markets for solar applications in terms of size and technology. Moreover, even though the Indian government encourages local solar manufacturing, investment activity is still limited. As a result, imported modules are perhaps the most bankable when it comes to considerations for module bankability, whether it is quality, brand, or price.

According to an article written in the energy world, the cumulative amount of the country’s solar imports in FY17, FY18, and FY19 were $3,196.5 million, $3,837.6 million, and $2,159.7 million, respectively. Around 85% of solar cells and modules are supplied by Chinese companies to India.

Manufacturers of solar power generation equipment in India face a problematic situation due to high import duties on raw materials and the high cost of shipping, making it impossible to increase manufacturing in the region. Moreover, with such a large percentage of India’s solar panels and modules imported from China, an increase in prices has worried developers. The debate over whether to build tariff walls to allow India’s manufacturing industry to grow behind them, or to enable Indian solar energy companies to profit from low-cost imports of modules, has raged for years.

This year, on another side, has also seen a renewed drive for domestic manufacturing in India’s solar industry to reduce the country’s reliance on imports. However, the COVID-19 disrupting global supply chains created a severe market shock, according to Du & Bradstreet, which has offset the Indian economy’s positive signs of growth that were apparent towards early 2021, affecting the module market. And, while there was an attempt to weather the impact of the first covid wave with the assistance of emergency cost cuts, the advent of the second wave has forced the Indian manufacturers to tighten their belts even further.

The impending crisis has undoubtedly emerged as a wake-up call for the solar PV sector, emphasizing our dependence on “imports.” Therefore, our government has high time to bring practical proposals to construct new made-in-India manufacturing facilities for PV modules and energy storage. This will not only alleviate reliance on imports but will also result in the creation of jobs.

About Author

Nikita Tiwari is a Graduate in Energy Engineering with MBA in business analytics from BIT MESRA.

Connect with her at: [email protected]